One of the most recent developments in influencer marketing has been happening in the Chinese market. On its surface, Key Opinion Leader (KOL) marketing, or KOL marketing, is essentially the use of social media influencers in advertising. In reality, however, it is a lot more than that.

Users of mainstream social media platforms such as YouTube will already be familiar with this concept – those with significantly large followings get paid to market a company’s goods or services through their content on the platform. In China, however, YouTube is banned, along with many social media platforms. So, while the form of influencers is largely the same (famous people with large audiences) the different media landscape in China has led to a different type of ecosystem in which there are different marketing strategies and models at play.

WeChat, for example, reached its billion-user milestone at the end of 2018, and 90% of those users can be found within China. KOL marketing allows brands to advertise on platforms like WeChat in order to reach potential customers.

The Wanghong Economy

The number of KOLs in China has grown so much that there is now a term for the ecosystem in which they operate – the wanghong economy. Wanghong (网红) is Mandarin for “internet celebrity” or “internet fame” and so the “wanghong economy” can be understood as the emerging digital economy in China based on influencer marketing.

This economy is an online marketplace characterised by a collective of KOLs who leverage their image of beauty or affluence in order to create content which promotes goods or services. Now of a comparable size to China’s cinema box office, it should be seen as an opportunity for brands to strengthen themselves.

Business models

KOL marketing in China comprises two main business models: online retailing and social media advertising.

In the online retailing model, KOLs promote their own products or services through engaging content in order to sell them using C2C websites such as TaoBao. KOLs are in effect their own product models in that they create posts that show off their self-branded products. In the area of cosmetic products such as lipstick, for example, they will apply it to themselves. In some cases, KOLs work with manufacturers to create products that they can license, and then promote those products on social media.

This business model is consumer driven. Products succeed or fail as a direct result of their online reception, and KOLs tend to interact with their followers on a regular basis in order to survey their needs. Follower loyalty is created on the assumption that followers can look like or even become like KOLs by using their products. Consumers feel that KOLs are relatable, and that makes those consumers more receptive to their products and easier to sell to.

Zhang Dayi is a good example of a KOL who uses this business model with great success. Her follower count on Weibo is approaching 12 million, and her shop on Taobao made 340 million yuan (€43.8 million) on Singles Day in 2019 alone.

In the social media advertising model, KOLs work with brands that are already established in order to advertise that brand’s products or services to their followers through content. If KOLs have enough followers, companies will pay them to create relatable content designed to engage and motivate followers to buy the company’s products. Alternatively, companies can turn brand pages themselves into KOLs of sorts by using techniques such as informal tone of voice and creative audience interaction.

In terms of payment models, KOLs can generate revenue through fixed fees, product giveaways or result-based fees. There is no real agreed pricing structure for fixed fees, and so platforms such as WeChat can set their own prices, and due to the steep rise in giveaway posts, some platforms are looking at creating stricter rules around them.

Influencer incubators

Though KOLs exhibit a lifestyle that seems enviable on the surface, it takes a lot of effort to become and remain one. Most KOLs (93% by one estimate) are moulded by influencer management companies such as Ruhnn Holding, one of China’s largest. These companies identify potential candidates and then put them through a series of tests to assess their viability.

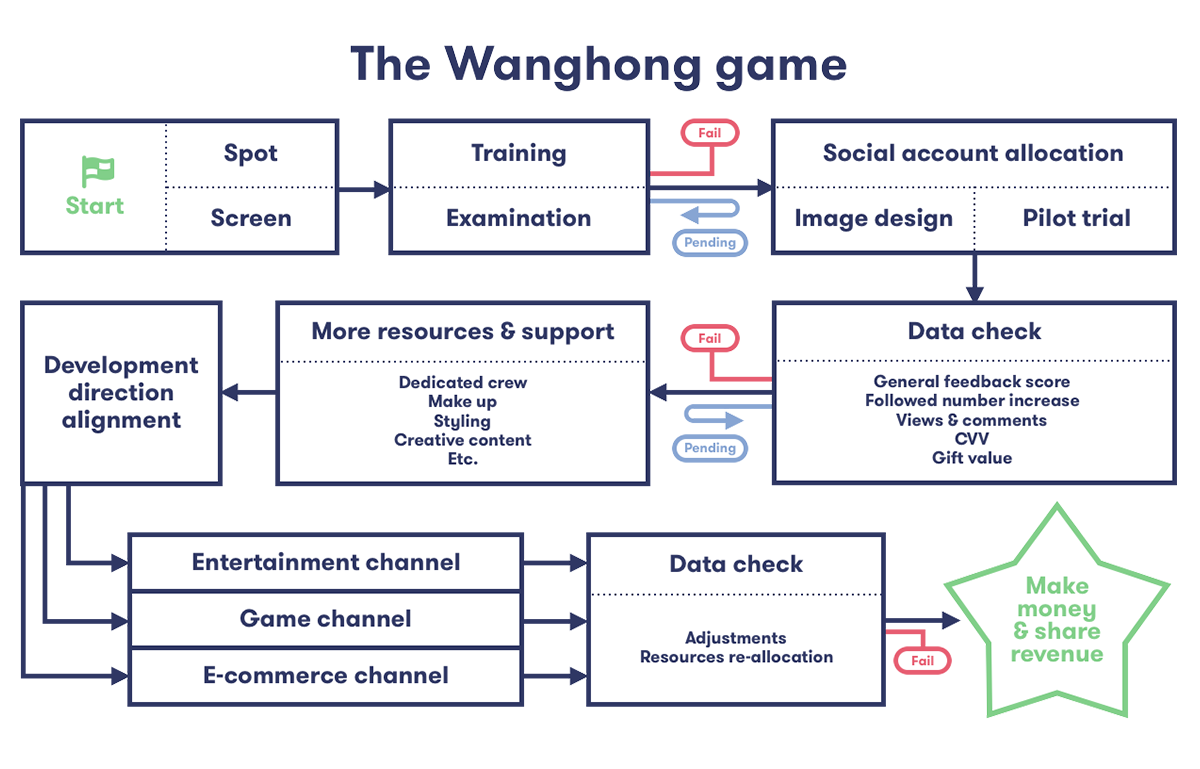

Here is the typical process:

Talent scouts are always on the lookout for upcoming talent and will identify people who show potential to become influencers. The people who get identified undergo training and an examination to assess whether they have what it takes to be a KOL. If someone fails here, they can either quit or try again. If they pass, they can proceed to the next stage.

Once someone has passed an examination, resources are allocated to them in order to design their image, and a social account is allocated to them to begin generating a following. Their performance is reviewed over a certain period of time, checking for key metrics such as follower count, views and comments, and so on. If someone fails here, they can either quit or potentially try again. If they pass, they can proceed to the next stage.

If the evaluation goes well, more resources are allocated to that person. This can include provisions such as a professional make-up artist or a creative team to help come up with ideas. At this point, the person becomes a fully-fledged KOL and the management company will assign them to one of three channels – entertainment, gaming, or e-commerce – based on their strengths.

Example platform: Bilibili

There are estimated to be over 0.5 billion users on streaming platforms in China. In gaming – one of the three major channels – some of the biggest streaming platforms online are Bilibili, Douyu TV and Huya Inc. In Q3 of 2019, Bilibili reported 127.9 million monthly active users and 7.9 million paying users.

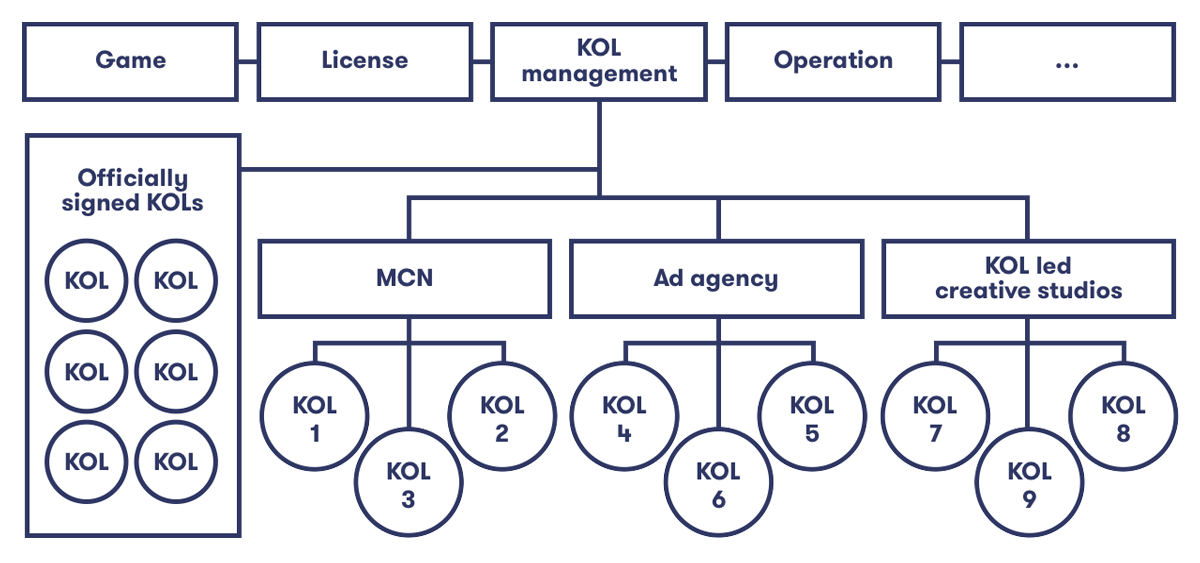

The sheer size of this new type of economy has led to the emergence of many different types of services within it, such as production centres and blogger multi-channel network (MCN) agencies, which specialise in promoting their clients on social networks. MCNs can also handle digital distribution. For KOLs, the maturity level of platforms is a key factor in determining their loyalty to them.

A brief look at Bilibili’s model shows how some of these different services interrelate. Aside from its main business areas of gaming, licensing and operations, the company makes use of an extensive KOL management subsystem.

Many KOLs use sponsorship as a way of collaborating with companies. However, this practice is tightly regulated in China. KOLs are not allowed to accept sponsorships privately. Sponsorships must be put on record in advance by an MCN, agency, or studio, and all videos are screened before they’re allowed to be posted, with penalties being given for unreported sponsorships.

Matchmade in China

Classically, celebrities have sold products through their personality. This has been no different in China, where corporate ads are not trusted well at all, but influencers receive a relatively high level of trust. The USP of KOLs is their role as brand ambassadors.

A regular Chinese consumer will be more inclined to buy products or services from a relatable person that they can see with their own eyes and interact with in real-time. According to a report from AdMaster, about 40% of Chinese consumers have been influenced by KOLs in making purchasing decisions. In addition, 1.5% of consumers would make a purchase immediately after a KOL posts about products on Weibo.

While sharing similarities with the marketing styles of other countries, this new system of KOLs has its own unique properties. Understanding those properties can be used as an opportunity to reach new consumers. In the West, for example, there is a much greater emphasis on organic growth, whereas the influencer incubator process (shown above) produces a much more manufactured style of growth.

Last year, the wanghong economy was valued at 53 billion yuan (€6.83 billion), and there is no doubt that it will continue to grow in size as consumers learn more and more the way in which they want to be advertised to. With our new office in Shanghai, we have equipped ourselves with the capability to serve west-to-China clients and to promote their products to China.

For any inquires, please feel free to contact [email protected]